Welcome to MakVik

Blog

Safeguard Your Future: Why Liability Planning Matters for Salaried Individuals

Many salaried individuals focus primarily on building wealth through saving and investing. While these are crucial aspects of financial planning, liability planning is equally important, often overlooked.

What is Liability Planning?

Liability planning involves strategies to protect yourself from unexpected financial burdens that could arise due to lawsuits, accidents, or unforeseen circumstances.

Liability: In the context of personal finance, liability refers to a legal or financial obligation that you owe to another person or entity. It's essentially something you are responsible for paying or doing.

Why is it Important for Salaried Individuals?

While salaried individuals may have a steady income, they are still susceptible to liabilities. Here's why liability planning is essential:

- Lawsuits: Even if you're not at fault, a lawsuit can be expensive to defend. Liability insurance can help cover legal fees and potential judgments.

- Accidents: An accident, even a minor one, can lead to medical bills and lost wages. Disability insurance can replace a portion of your income if you're unable to work due to an injury or illness.

- Debt: Unexpected medical bills or other high-interest debt can derail your financial security.

- Peace of Mind: Liability planning provides peace of mind, knowing you and your family are protected from unforeseen financial hardships.

Strategies for Liability Planning:

- Emergency Fund: A healthy emergency fund can cover unexpected expenses, reducing reliance on high-interest debt. Aim for 3-6 months of living expenses.

- Liability Insurance:

- General Liability Insurance: Protects you from personal injury or property damage lawsuits.

- Professional Liability Insurance (if applicable): Protects you from lawsuits related to your professional work.

- Homeowner's/Renter's Insurance: Protects your property and assets in case of fire, theft, or other covered events.

- Auto Insurance: Mandatory in most areas. Protects you from financial responsibility in case of an auto accident.

- Disability Insurance: Provides income replacement if you're unable to work due to an illness or injury.

Here are some additional tips for Liability Planning:

- Review your employer-provided insurance plans. Many companies offer health, disability, and life insurance benefits.

- Consult a financial advisor to create a personalized liability planning strategy based on your risk tolerance and needs.

- Maintain good credit: A good credit score can help you qualify for lower insurance premiums.

Liability planning is an essential component of a comprehensive financial plan for salaried individuals. By taking proactive steps to protect yourself financially, you can ensure a secure future for yourself and your family. Don't wait for a crisis to strike – start planning today!

#LiabilityPlanning #FinancialSecurity #SalariedIndividuals #PeaceOfMind #RiskManagement #FinancialPlanning #EmergencyFund #Insurance

The Power of 40s: Financial Strategies to Thrive in Your Prime

Your 40s are a dynamic decade. You've likely established a career, may have a family, and your priorities are shifting. Financially, it's time to make your money work for you and secure a comfortable future. Here are key strategies to maximize your financial potential in your 40s:

-

1. Conquer Your Debt:

- Prioritize High-Interest Debt: Focus on eliminating high-interest credit card debt. Explore consolidation loans or balance transfer options to secure a lower interest rate.

- Develop a Debt Repayment Plan: Create a realistic plan to pay off remaining debts like student loans or car loans. Consider the snowball or avalanche method based on your interest rates and motivation.

-

2. Supercharge Your Emergency Fund:

- Aim for 6-12 Months of Expenses: Life gets more complex in your 40s. Unexpected events can be financially draining. Increase your emergency fund to 6-12 months of living expenses to weather potential storms.

-

3. Maximize Retirement Savings:

- Increase Contributions: You might be earning more now. Take advantage of employer matching and aim to save 15-20% of your income towards retirement. Consider catch-up contributions if you're behind on your goals.

- Diversify Your Portfolio: Review your retirement account asset allocation. Ensure a healthy mix of stocks, bonds, and other assets based on your risk tolerance and time horizon.

-

4. Boost Your Earning Potential:

- Negotiate Your Salary: Don't undervalue your expertise. Research your worth and negotiate a raise if you deserve one.

- Explore Additional Income Streams: Consider freelance work, side hustles, or passive income options to boost your income and accelerate your financial goals.

-

5. Plan for Education Costs:

- College Savings for Children: If you have children, start saving for their college education early. Utilize 529 plans or other tax-advantaged options.

-

6. Review and Update Insurance Coverage:

- Life Insurance: Evaluate your life insurance needs based on your dependents and financial obligations.

- Disability Insurance: Consider disability insurance to protect your income in case of an unforeseen illness or accident.

- Long-Term Care Insurance: Explore long-term care insurance options to safeguard your assets in case of future healthcare needs.

-

7. Embrace Estate Planning:

- Create a Will: Ensure your assets are distributed according to your wishes.

- Consider a Power of Attorney: Designate someone you trust to make financial decisions on your behalf if you're incapacitated.

-

8. Prioritize Health and Wellness:

- Invest in Your Health: Maintaining good health reduces future medical expenses. Prioritize healthy habits and preventive care.

- Review Health Insurance: Ensure your health insurance plan adequately covers your needs.

-

9. Seek Professional Guidance (If Needed):

- Consult a Financial Advisor: A financial advisor can provide personalized guidance on complex financial matters like retirement planning or estate planning.

Your 40s are a time to solidify your financial foundation and pursue your long-term goals. By implementing these strategies and making informed financial decisions, you'll be well on your way to a secure and fulfilling future.

Financial well-being empowers you to live life on your own terms. By taking charge of your finances in your 40s, you're investing in a secure and fulfilling future for yourself and your loved ones.

#FinancialPlanning #MoneyManagement #FinancialGoals #DebtFreeCommunity #RetirementPlanning #40sAndThriving #FinancialSecurity

Level Up Your Finances: Top Strategies for Your 20s

Your 20s: a time of exploration, independence, and endless possibilities. But amidst the excitement, laying a solid financial foundation is crucial. Don't let financial anxieties hold you back! Here are key strategies to rock your finances in your 20s:

-

1. Budgeting Basics are Your Best Friend:

- Track Your Spending: Awareness is key. Use budgeting apps or a simple spreadsheet to understand where your money goes. Every penny counts!

- Create a Realistic Plan: Allocate income for necessities (rent, food, bills), savings, and some fun money. Prioritize needs over wants. There are free budgeting templates available online to get you started.

-

2. Build Your Emergency Fund:

- Life throws curveballs. Aim for 3-6 months of living expenses in a savings account. This safety net protects you from unexpected costs without resorting to high-interest debt.

-

3. Tackle Debt Strategically:

- Student Loans: They might seem daunting, but prioritize making at least the minimum payments. Explore income-driven repayment plans if needed.

- Credit Card Debt: High-interest rates can spiral out of control. Develop a plan to pay them off aggressively. Consider a debt snowball method (paying off smallest debts first for motivation) or avalanche method (focusing on debts with the highest interest rates first).

-

4. Embrace the Power of Saving:

- Even small amounts add up! Automate transfers to a high-yield savings account to build a healthy emergency fund and kickstart your savings goals.

-

5. Start Investing Early (Even if it's Small):

- Time is your greatest asset. Start investing a portion of your income, even if it's a small amount. Take advantage of compound interest - watch your money grow over time!

- Robo-advisors offer automated investment management, perfect for beginners. Explore low-cost index funds for a diversified and low-maintenance approach.

-

6. Build Your Credit Score:

- Your credit score impacts loan approvals and interest rates. Pay bills on time and avoid excessive credit card debt usage. Consider a secured credit card to build your credit history if you have no credit score yet.

-

7. Don't Neglect Insurance:

- Get basic health insurance to safeguard yourself from unexpected medical costs. Consider renter's insurance if you're renting an apartment.

-

8. Seek Out Additional Income Streams (Optional):

- Freelancing, side hustles, or a part-time job can boost your income and accelerate your financial goals. Focus on areas that leverage your skills and interests.

-

9. Embrace Financial Literacy:

- Knowledge is power. Educate yourself! Read personal finance blogs, listen to podcasts, and take advantage of free financial workshops. The more you know, the better equipped you are to make informed financial decisions.

-

10. Enjoy the Journey:

- Financial planning shouldn't be restrictive. Factor in some fun! But prioritize your financial goals to avoid future regrets.

Your 20s are a springboard for your financial future. By following these strategies and making smart choices, you'll be well on your way to financial freedom and achieving your dreams. Remember, it's a marathon, not a sprint! Be patient, stay consistent, and celebrate your milestones along the way.

Financial well-being empowers you to live life on your own terms. By taking charge of your finances in your 20s, you're investing in a secure and fulfilling future for yourself and your loved ones.

#PersonalFinance #MoneyManagement #FinancialGoals #BudgetingTips #DebtFreeCommunity #FinancialLiteracy #MoneySaving #YoungAndThriving #Adulting101 #MillennialMoney #FinancialFreedom #FinancialEmpowerment

Your 30s: Mastering the Money Game - Financial Strategies for a Secure Future

Your 30s are a pivotal decade. You're likely establishing your career, building a family, and navigating a dynamic social life. But amidst the whirlwind, it's crucial to prioritize your financial well-being. Here are key financial strategies to master in your 30s for a secure and fulfilling future:

-

1. Tame the Debt Monster:

- Student Loans: They might feel like a permanent fixture, but prioritize paying them off aggressively. Consider refinancing for a lower interest rate if possible.

- Credit Card Debt: High-interest credit card debt can cripple your finances. Develop a plan to eliminate it with a debt snowball or avalanche method.

- Lifestyle Debt: Avoid unnecessary debt for keeping up with appearances. Prioritize needs over wants.

-

2. Build an Emergency Fund:

- Aim for 3-6 months of living expenses in a savings account readily accessible for emergencies like job loss or medical bills.

- This safety net provides peace of mind and prevents resorting to high-interest debt during unexpected situations.

-

3. Retirement Planning - It's Not Early!

- Time is your greatest ally in building retirement wealth. Start contributing to your retirement plan (401(k) or IRA) as early as possible, and take advantage of employer matching contributions.

- Even small contributions now will grow significantly over time due to compound interest.

-

4. Invest for Growth:

- Don't let your savings stagnate in low-interest accounts. Invest a portion of your income in diversified assets like stocks, bonds, and mutual funds based on your risk tolerance and time horizon.

- Consider robo-advisors for automated investment management if you're new to investing.

-

5. Protect What Matters:

- Get adequate health insurance to safeguard yourself and your family from unexpected medical costs.

- Consider life insurance if you have dependents to ensure their financial security in your absence.

- Explore disability insurance to protect your income in case of an unforeseen accident or illness.

-

6. Automate Your Finances:

- Set up automatic transfers for savings and bill payments. This ensures timely payments and reduces the risk of missed payments and late fees.

- Budgeting apps can help you track income and expenses, identify areas for improvement, and stay on track with your financial goals.

-

7. Embrace Continuous Learning:

- Financial literacy is key. Read books, attend workshops, and leverage online resources to enhance your financial knowledge.

- Stay updated on investment trends and tax regulations to make informed financial decisions.

-

8. Seek Professional Help (If Needed):

- Don't hesitate to consult a financial advisor for personalized guidance, especially regarding complex financial matters like estate planning or creating an investment portfolio.

Your 30s are a golden window to build a solid financial foundation. By implementing these strategies and making smart financial choices, you'll be well on your way to achieving financial security and realizing your long-term goals.

Bonus Tip: Don't be afraid to negotiate your salary! Your 30s are often your prime earning years, so ensure you're being fairly compensated for your skills and experience.

Taking Control of Your Future:

Financial well-being empowers you to live life on your own terms. By taking charge of your finances in your 30s, you're investing in a secure and fulfilling future for yourself and your loved ones.

#FinancialPlanning #MoneyManagement #PersonalFinance #FinancialGoals #InvestingTips #DebtFreeCommunity #FinancialLiteracy #EmergencyFund #RetirementPlanning #DebtFreeJourney #InvestingForTheFuture #AutomateYourFinances

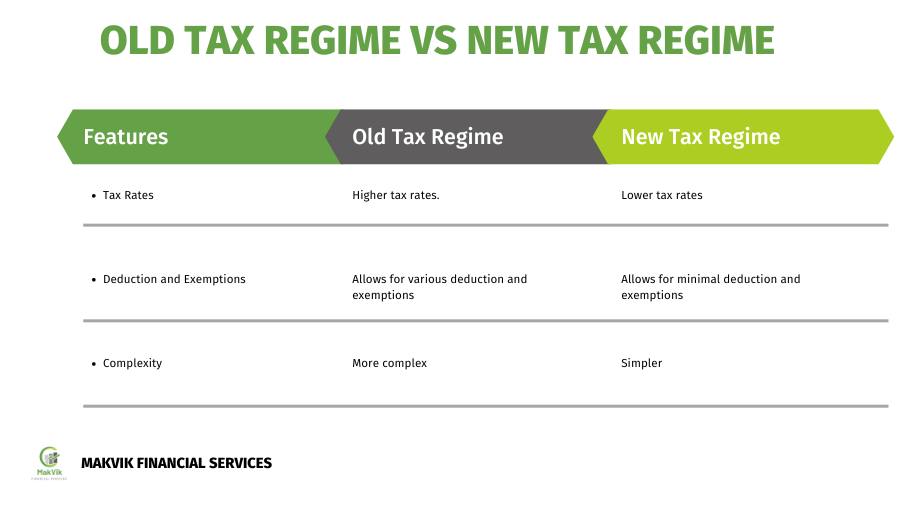

How to Choose the Best Tax Regime for You: Old Tax Regime vs. New Tax Regime

Choosing the right tax regime can significantly impact your final tax liability. In India, taxpayers have the option to choose between the old tax regime and the new tax regime introduced in the 2020 budget. Both regimes have their own set of advantages and disadvantages, and the best choice for you depends on your individual financial situation.

Old Tax Regime:

- This is the traditional tax regime that has been in place for many years.

- It allows for various deductions and exemptions under various sections of the Income Tax Act, such as deductions for medical expenses, house rent allowance (HRA), interest on home loan, etc.

- Taxpayers can claim standard deduction or choose to claim various deductions and exemptions under various sections.

New Tax Regime:

- This is a simplified tax regime introduced to reduce the tax burden and ease tax filing.

- It offers lower tax rates compared to the old regime.

- However, it does not allow for most deductions and exemptions available under the old regime.

Choosing the Right Regime for You

The best tax regime for you depends on several factors, including:

- Income level: If your income is low and you claim a significant amount of deductions, the old tax regime might be more beneficial. However, if your income is high and you don't utilize many deductions, the new tax regime could be a better option.

- Investment habits: If you invest heavily in tax-saving instruments like PPF, ELSS, etc., the old regime might be more advantageous. However, if you don't invest much in these instruments, the new regime could be a better fit.

- Tax filing preferences: If you prefer a simpler tax filing process, the new regime might be more appealing. However, if you're comfortable with a more complex process and can utilize various deductions, the old regime might be a better choice.

Here are some additional tips for choosing the best tax regime:

- Calculate your tax liability under both regimes: Use a tax calculator or consult a tax advisor to calculate your tax liability under both regimes. This will help you see which regime offers you a lower tax burden.

- Consider your future plans: If you plan to make significant investments in tax-saving instruments in the future, the old tax regime might be a better option.

- Stay updated: Tax laws and regulations can change from time to time. It's important to stay updated on the latest changes to make informed decisions about your tax regime.

Choosing the right tax regime can save you a significant amount of money. By carefully considering your individual financial situation and using the tips provided in this blog post, you can make an informed decision about which regime is best for you.

#TaxPlanning #IncomeTax #NewTaxRegime #OldTaxRegime #TaxTips #Finance #MoneySaving #IndiaTax #IndianTaxes

The Future of Finance: Exploring Trends and Innovations

The financial landscape is undergoing a dynamic transformation, driven by a wave of technological advancements and evolving consumer demands. This blog post delves into some of the most prominent trends and innovations shaping the future of finance, offering a glimpse into what lies ahead for the industry.

1. Rise of Fintech: A Tech-Driven Revolution

Financial technology, or Fintech, is at the forefront of this transformation. From mobile banking apps and digital wallets to robo-advisors and blockchain technology, Fintech is revolutionizing the way we access, manage, and invest our money. These innovations offer greater convenience, personalization, and efficiency, making financial services more accessible and user-friendly.

2. Artificial Intelligence (AI) and Machine Learning (ML): Powering Informed Decisions

AI and ML are rapidly changing the financial game. These technologies are used to analyze vast amounts of financial data, predict market trends, automate tasks, and personalize financial products and services. AI-powered chatbots provide 24/7 customer support, while algorithmic trading optimizes investment strategies. As AI and ML continue to evolve, we can expect even more sophisticated applications in the financial sector.

3. Blockchain: Building a Secure and Transparent Future

Blockchain technology, the foundation behind cryptocurrencies like Bitcoin, is making waves in the financial world. This distributed ledger system offers a secure and transparent way to record transactions, eliminating the need for intermediaries. Blockchain has the potential to revolutionize various financial processes, from cross-border payments and trade finance to asset management and identity verification.

4. Open Banking: Fostering Collaboration and Innovation

Open banking allows third-party financial institutions to access customer data with their consent. This creates a more open and collaborative ecosystem, fostering innovation and competition. Open banking can lead to the development of new financial products and services that cater to specific customer needs, ultimately benefiting consumers.

5. The Rise of Decentralized Finance (DeFi): A Peer-to-Peer Revolution

DeFi refers to financial services built on blockchain technology, bypassing traditional institutions. DeFi offers a more democratized and accessible financial system, allowing individuals to borrow, lend, and invest directly with each other. While DeFi holds immense potential, it's still a nascent market with its own set of risks and regulations to navigate.

6. Evolving Regulatory Landscape: Adapting to Innovation

As financial technology continues to evolve, regulators face the challenge of balancing innovation with consumer protection and financial stability. We can expect new regulations to emerge that address the risks and opportunities associated with Fintech, ensuring a safe and secure financial environment for all.

The Future of Finance: A Brighter Horizon

These trends and innovations paint a picture of a future where finance is more accessible, efficient, and personalized. As technology continues to develop, we can expect even more exciting advancements that transform the way we manage our money. By embracing these changes, the financial industry can create a more inclusive and prosperous future for everyone.

#FutureOfFinance #Fintech #Innovation #FinancialTechnology #MakVik

5 Tips for Managing Your Student Loan Debt

Student loans can be a significant financial burden for many graduates. The good news is there are strategies you can implement to effectively manage your student loan debt and achieve financial freedom sooner. This blog post from MakVIK Financial Services will equip you with five valuable tips to tackle your student loans with confidence.

-

1. Understand Your Loans:

The first step to managing your student loans effectively is to gain a clear understanding of them. Gather all your loan documents and make a list of each loan, including the following details:

- Loan servicer: The company you make payments to.

- Original loan amount: The total amount you borrowed.

- Current loan balance: The remaining amount you owe.

- Interest rate: The annual percentage rate (APR) charged on the loan.

- Repayment term: The length of time you have to repay the loan in full.

Having this information readily available allows you to prioritize your loans and explore repayment options strategically.

-

2. Explore Repayment Plans:

Federal student loans offer various repayment plans to fit your financial situation. Explore options like income-driven repayment plans that adjust your monthly payment based on your income and family size. You can find more information and compare repayment plans on the Department of Education website (https://studentaid.gov/).

-

3. Consider Consolidation:

If you have multiple federal student loans, consolidating them can simplify your repayment process. Consolidation combines your loans into a single loan with one monthly payment and potentially a lower interest rate. However, weigh the pros and cons before consolidating, as it might extend your repayment term.

-

4. Prioritize High-Interest Loans:

Focus on paying off your loans with the highest interest rates first. This strategy helps you save money on interest in the long run. You can use a snowball or avalanche method to tackle your loans. The snowball method involves paying off the smallest loan first to gain momentum, while the avalanche method targets the loan with the highest interest rate first to save the most on interest.

-

5. Make Extra Payments Whenever Possible:

Even small extra payments can significantly reduce your student loan debt over time. Consider putting any additional income, such as tax refunds or bonuses, towards your loans. This accelerates your debt payoff and saves you money on interest.

-

6. Bonus Tip: Seek Help When Needed

Don't hesitate to seek help from financial aid counselors or student loan consolidation companies. They can provide guidance and resources specific to your situation.

By following these tips and staying committed to your repayment plan, you can effectively manage your student loan debt and achieve your financial goals. Remember, there's light at the end of the tunnel!

#StudentLoans #DebtManagement #FinancialTips #MakVIK

The Importance of Tax Planning in India: Save Money, Gain Peace of Mind

Taxes are an inevitable part of life in India. But that doesn't mean you have to simply accept a high tax burden. By incorporating strategic tax planning into your financial routine, you can significantly reduce your tax liability and keep more of your hard-earned money. This blog post from MakVIK Financial Services will explain why tax planning is crucial in India and provide valuable tips to help you navigate the tax system effectively.

Why Tax Planning Matters in India

- Minimize Tax Outgo: Tax planning allows you to take advantage of deductions, exemptions, and tax-saving schemes offered by the Indian government. By strategically utilizing these benefits, you can legally reduce your taxable income and minimize the amount of tax you pay.

- Financial Freedom and Goal Achievement: Saving money on taxes translates to more disposable income. This financial freedom allows you to allocate more funds towards your financial goals, such as saving for retirement, a child's education, a dream vacation, or a down payment on a home.

- Peace of Mind and Reduced Stress: Tax season can be stressful, especially if you're not prepared. Proper tax planning ensures you meet deadlines, avoid penalties for late filing, and approach tax season with confidence.

- Improved Financial Discipline: Tax planning encourages you to stay organized with your finances throughout the year. Tracking income, expenses, and investments becomes crucial for maximizing tax benefits, ultimately promoting healthy financial habits.

Tax Planning Tips for India

- Know Your Tax Bracket and Deductions: Familiarize yourself with the current tax slabs in India and the deductions you're eligible for. This knowledge helps you plan your finances and investments to maximize tax benefits. Resources like the Income Tax Department website (https://www.incometax.gov.in/iec/foportal/) can be a helpful starting point.

- Invest in Tax-Saving Instruments: Consider investing in instruments like Public Provident Fund (PPF), Employee Provident Fund (EPF), Equity Linked Savings Schemes (ELSS) mutual funds, and National Pension System (NPS) to benefit from tax deductions and exemptions.

- Claim Deductible Expenses: Keep track of expenses like medical bills, home loan interest payments, charitable donations, and education fees. These can be claimed as deductions, further reducing your taxable income.

- Maintain Organized Records: Proper record-keeping of income sources, investments, and expenses is essential for filing accurate tax returns. This simplifies the process and avoids potential issues during tax assessment.

- Seek Professional Guidance (Optional): Consider consulting a qualified tax advisor for personalized advice tailored to your specific financial situation. A tax advisor can help you identify the most effective tax-saving strategies and ensure compliance with tax regulations.

By incorporating these tax planning tips into your financial strategy, you can take control of your tax burden and achieve your financial goals more effectively. Remember, a little planning today can lead to significant savings in the long run. For personalized tax advice tailored to your specific situation, consulting a qualified tax advisor at MakVIK is highly recommended.

#TaxPlanning #TaxSavingTips #India #Finance #MakVIK

Mutual Funds vs. Index Funds: Choosing the Right Investment for You

The world of investment offers a multitude of options, and choosing the right investment vehicle can be overwhelming. Two popular choices are mutual funds and index funds. While both can be valuable tools for building wealth, they have distinct characteristics. Understanding these differences is crucial for making informed investment decisions. Let's delve into the key aspects of mutual funds and index funds to help you select the investment that aligns best with your financial goals and risk tolerance.

1. Mutual Funds: Actively Managed Portfolios

Mutual funds pool money from various investors and invest it in a basket of assets like stocks, bonds, or a combination of both. A professional fund manager actively manages the fund, making investment decisions based on market research and analysis. The goal is to outperform the market and generate returns for investors.

- Potential for Higher Returns: Skilled fund managers can potentially outperform the market and deliver higher returns than the overall market average.

- Higher Fees: Actively managed mutual funds typically have higher expense ratios compared to index funds due to the costs associated with research and management.

- More Risk: The performance of a mutual fund heavily relies on the skill and decisions of the fund manager. There's a chance the fund underperforms the market.

2. Index Funds: Passive Investing

Index funds track a specific market index, such as the Nifty 50 or Sensex. They passively invest in the same companies that make up the index, in proportion to their weightage. There's no active management involved; the fund simply mirrors the performance of the underlying index.

- Lower Costs: Index funds generally have lower expense ratios compared to mutual funds due to the passive management style.

- Market-Matched Returns: Index funds aim to deliver returns that closely match the performance of the tracked index.

- Lower Risk (Generally): Since they mirror the market, index funds tend to be less volatile than actively managed funds.

Choosing between mutual funds and index funds depends on your investment goals, risk tolerance, and investment time horizon. Here's a quick guide:

- Consider Mutual Funds If: You have a high-risk tolerance and are seeking potentially higher returns than the market average. You're comfortable with the added risk associated with actively managed funds.

- Consider Index Funds If: You prioritize lower investment costs and a long-term investment approach. You're comfortable with returns that match the overall market performance.

It's important to remember that both mutual funds and index funds have their place in a well-diversified investment portfolio. You can even consider a combination of both approaches to achieve your financial goals. Consulting a qualified financial advisor at MakVIK can help you assess your risk tolerance, investment objectives, and recommend the investment strategy that best suits your needs.

#MutualFunds #IndexFunds #Investment #FinancialPlanning #MakViK

Building a Strong Investment Strategy: Key Considerations for Long-Term Success

The exciting world of investing holds immense potential for building wealth and achieving financial goals. However, navigating this landscape requires a well-defined investment strategy. This strategy serves as a roadmap, guiding your investment decisions and keeping you on track for long-term success. Let's explore some key considerations for building a strong investment strategy that aligns with your unique financial aspirations.

1. Define Your Financial Goals

The foundation of any sound investment strategy lies in clearly defined financial goals. What are you investing for? Retirement? A child's education? A dream vacation? Identifying your goals and their timeframes will determine your investment approach and risk tolerance.

2. Assess Your Risk Tolerance

Not all investors are created equal. Some are comfortable with higher risks in pursuit of potentially greater returns, while others prioritize capital preservation. Understanding your risk tolerance is crucial for making informed investment decisions. Consider factors like your age, financial situation, and risk appetite to determine the risk profile that aligns best with you.

Here are some additional elements for building a strong investment strategy:

- Asset Allocation and Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, cash equivalents, real estate) helps mitigate risk. Asset allocation refers to the strategic distribution of your investment capital across these asset classes based on your risk tolerance and goals.

- Do Your Research: Before investing in any individual stock or fund, conduct thorough research to understand the underlying company or asset. Consider its financial health, future prospects, and market trends.

- Invest for the Long Term: Building wealth is a gradual process. Avoid impulsive decisions based on market fluctuations. Stay focused on your long-term goals and invest with a disciplined approach.

- Rebalance Your Portfolio Regularly: The market landscape and your financial needs can evolve over time. Periodically rebalance your portfolio to ensure it maintains your target asset allocation and risk profile.

- Seek Professional Guidance (Optional): Consulting a qualified financial advisor can be beneficial, especially for beginners. They can provide personalized investment advice tailored to your specific circumstances and goals.

By incorporating these considerations and continuously educating yourself, you can craft a robust investment strategy that propels you towards achieving your financial aspirations. Remember, investing is a journey, and with careful planning and disciplined execution, you can navigate the path to long-term success.

#InvestmentStrategy #FinancialGoals #RiskTolerance #AssetAllocation #LongTermInvesting

Understanding Stock Market Indexes: A Compass for Navigating the Market

Venturing into the stock market can be an exciting yet daunting experience. With a vast array of companies and ever-fluctuating prices, navigating this landscape requires effective tools. Stock market indexes emerge as valuable resources, offering a snapshot of the overall market performance and specific sectors. Let's delve deeper into understanding stock market indexes and how they can be utilized as a compass for informed investment decisions.

What are Stock Market Indexes?

Imagine a hypothetical portfolio that tracks the performance of a specific segment of the stock market. This portfolio is essentially a stock market index. It comprises a selection of companies, typically chosen based on market capitalization, industry representation, or other criteria. By tracking the price movements of these underlying stocks, the index reflects the overall performance of that particular market segment.

How Do Stock Market Indexes Help Investors?

Stock market indexes serve as valuable tools for investors in numerous ways:

- Market Performance Benchmark: Indexes provide a benchmark to gauge the overall market performance or the performance of a specific sector. By comparing an individual stock's performance against a relevant index, investors can assess if the stock is outperforming or underperforming the broader market.

- Identifying Market Trends: Analyzing index movements over time can help investors identify trends and potential investment opportunities. For instance, a rising index might suggest a bull market, while a declining index could indicate a bear market.

- Portfolio Diversification: Certain indexes, like the S&P 500, offer diversified exposure to a large basket of stocks. By investing in index funds or ETFs that track these indexes, investors can achieve instant diversification without needing to pick individual stocks.

Here are some additional points to remember about stock market indexes:

- Different Types of Indexes Exist: There are various stock market indexes, each with its own composition and focus. Some popular examples include the S&P 500 (large-cap US stocks), Dow Jones Industrial Average (DJIA) (30 large-cap US stocks), and Nasdaq Composite (technology-heavy stocks).

- Indexes Don't Represent the Entire Market: It's crucial to remember that indexes only track a selection of stocks. The overall market performance may differ slightly from the movement of a specific index.

- Indexes are Indicators, Not Investment Decisions: While valuable, indexes shouldn't solely dictate your investment choices. Consider your individual risk tolerance and investment goals when making investment decisions.

Understanding stock market indexes empowers you to navigate the market with greater clarity and make

#MutualFund #InvestmentStrategy #RiskManagement #FinancialPlanning #Investing101

Demystifying Mutual Funds: A Beginner's Guide to Investing for Growth

The world of investing can seem complex and intimidating, especially for beginners. But fear not! Mutual funds offer a powerful tool to participate in the market and potentially achieve long-term growth without needing to become a stock-picking expert. This blog post serves as a beginner's guide to understanding mutual funds, their core functionalities, and how they can be a valuable addition to your investment strategy.

What are Mutual Funds?

Imagine a pool of money contributed by various investors with similar investment goals. This pool is then managed by a professional fund manager who invests it in a diversified portfolio of stocks, bonds, or other assets. Each investor in the mutual fund owns a share of this portfolio, proportionate to their investment amount. This collective ownership structure is what makes mutual funds accessible and beneficial for beginners.

Benefits of Investing in Mutual Funds

Mutual funds offer several advantages for beginner investors, including:

- Diversification: Mutual funds hold a basket of various assets, spreading your investment risk across different sectors and companies. This reduces the impact of any single stock's performance on your overall portfolio.

- Professional Management: Experienced fund managers handle the investment decisions, research, and portfolio rebalancing, saving you time and effort.

- Affordability: Mutual funds allow you to invest with smaller amounts, making them accessible even for those with limited capital.

- Liquidity: Most mutual funds offer high liquidity, allowing you to redeem your shares for cash relatively easily.

Here are some additional points to consider when starting with mutual funds:

- Understand Your Investment Goals and Risk Tolerance: Choose a mutual fund that aligns with your long-term financial goals and risk appetite. Consider factors like your age, investment horizon, and comfort level with market volatility.

- Research Different Types of Mutual Funds: There are various mutual fund types based on asset allocation (stock, bond, or balanced) and investment strategies (growth, income, or value). Research different options to find one that aligns with your goals.

- Consider Fees and Expenses: Mutual funds typically have fees associated with management and administration. Compare fees across different funds before investing.

- Invest for the Long Term: Mutual funds are well-suited for long-term investment horizons. Avoid short-term trading and focus on achieving your long-term financial objectives.

#MutualFund #InvestmentStrategy #RiskManagement #FinancialPlanning #Investing101

Understanding Asset Allocation: The Cornerstone of Successful Investing

The world of investing can be exciting yet daunting, filled with diverse options and complex strategies. However, one fundamental principle stands out – asset allocation. It serves as the backbone of a well-diversified portfolio, helping you manage risk and navigate market fluctuations towards your financial goals. Let's delve deeper into understanding asset allocation and its significance in crafting a successful investment strategy.

What is Asset Allocation?

Asset allocation refers to the process of dividing your investment portfolio across various asset classes. These categories typically include stocks, bonds, cash equivalents, and real estate. By strategically allocating your investment dollars across these asset classes, you aim to achieve a balance between risk and potential returns.

Why is Asset Allocation Important?

Asset allocation plays a crucial role in managing investment risk. Different asset classes generally exhibit varying risk and return profiles. Stocks, for example, offer the potential for higher returns but come with greater volatility. Bonds, on the other hand, typically provide lower returns but are considered less volatile. By strategically allocating your investments across these asset classes, you can create a more balanced portfolio that helps mitigate risk and potentially smooth out market fluctuations.

Here are some additional benefits of a well-defined asset allocation strategy:

- Aligns with Your Investment Goals: Your asset allocation should be tailored to your specific financial goals and risk tolerance. Younger investors with a longer time horizon can typically tolerate a higher allocation towards growth-oriented assets like stocks. Conversely, individuals nearing retirement may prioritize income and stability, favoring bonds and cash equivalents.

- Promotes Discipline and Reduces Emotional Investing: Asset allocation encourages a long-term perspective, helping you avoid impulsive decisions based on market swings. Sticking to your predetermined asset allocation can prevent emotional selling during downturns and knee-jerk reactions to market volatility.

- Provides Flexibility and Adaptability: Your asset allocation is not set in stone. As your life circumstances and financial goals evolve, you can adjust your asset mix accordingly. Regularly reviewing and rebalancing your portfolio to maintain your target asset allocation is essential.

Understanding asset allocation is a significant step towards becoming a more informed and confident investor. By strategically allocating your investments across different asset classes, you can build a diversified portfolio that aligns with your risk tolerance and propels you towards achieving your long-term financial objectives.

#AssetAllocation #InvestmentStrategy #RiskManagement #FinancialPlanning #Investing101

Choosing the Right Coverage for Your Business: A Customized Approach

In today's dynamic business landscape, protecting your company from unforeseen events is crucial. However, with a vast array of insurance options available, choosing the right coverage can feel overwhelming. The key lies in understanding your unique needs and tailoring your insurance strategy accordingly. Let's explore a customized approach to selecting the perfect insurance fit for your business:

1. Identify Your Business Risks and Exposures

Every business operates within a unique risk landscape. Conduct a thorough risk assessment to identify potential vulnerabilities, such as property damage, liability claims, cyber threats, and employee-related issues. This assessment will form the foundation for your insurance needs.

2. Evaluate Your Specific Needs and Budget

Consider factors like your industry, location, size, and financial resources. Don't blindly follow generic recommendations; prioritize coverage that directly addresses your identified risks and aligns with your budget constraints.

Here are some additional tips for a customized approach:

- Consult a Business Insurance Professional: An experienced agent can guide you through risk assessment, analyze your needs, and recommend suitable coverage options.

- Compare Quotes from Multiple Insurers: Don't settle for the first offer. Seek quotes from different providers to compare coverage, pricing, and customer service.

- Regularly Review and Update Your Coverage: Your business needs evolve over time, so revisit your insurance plan annually to ensure it continues to provide adequate protection.

- Understand Exclusions and Limitations: Carefully read your policy documents to understand what's covered and what's not. Ask clarifying questions if anything is unclear.

By taking a customized approach and carefully considering your unique business needs, you can make informed insurance decisions that safeguard your company's financial stability and future success.

#BusinessInsurance #RiskManagement #CustomizedCoverage #FinancialProtection #PeaceOfMind

Navigating Insurance Claims: What to Do After an Incident

Experiencing an accident or unexpected event can be stressful, and dealing with insurance claims can add another layer of confusion. However, staying calm and taking the right steps can make the process smoother and ensure you receive the compensation you deserve. Let's delve into what to do after an incident to navigate your insurance claim effectively:

1. Ensure Safety and Gather Information

The immediate priority is your safety and the safety of others involved. If necessary, seek medical attention and call the authorities to file a report. Document the scene with photos and videos if possible, and gather any relevant information like contact details of witnesses.

2. Promptly Contact Your Insurance Provider

Don't delay! Report the incident to your insurance company as soon as possible, ideally within 24 hours. Explain the situation clearly and accurately, and follow their instructions for filing a formal claim.

Here are some additional crucial steps to remember:

- Review Your Policy Carefully: Understand your coverage details, exclusions, and any specific requirements for filing a claim.

- Keep Records and Receipts: Maintain copies of all communication with your insurer, police reports, repair estimates, and any receipts related to the incident.

- Be Honest and Cooperative: Provide truthful information throughout the claims process and cooperate with any requests from your insurance company.

- Seek Professional Help if Needed: Consider consulting an attorney or insurance claims adjuster if you have complex questions or concerns.

Remember, navigating insurance claims can be complex, but by staying informed, acting promptly, and following these steps, you can increase your chances of a successful resolution and minimize stress during this challenging time.

#InsuranceClaims #ClaimsProcess #FinancialSecurity #PeaceOfMind #BePrepared

How to Prepare for a Life Insurance Consultation: A Step-by-Step Guide

Preparing for a life insurance consultation can seem daunting, but it doesn't have to be. By taking some proactive steps beforehand, you can ensure a productive and informative discussion with your insurance advisor. Let's explore a step-by-step guide to help you feel confident and prepared for your consultation:

Step 1: Gather Your Personal Information

Start by collecting essential information about yourself and your dependents, such as:

- Date of birth and health history (including any pre-existing conditions)

- Occupation and income level

- Family members and their ages (if applicable)

- Existing debts and financial obligations

- Current life insurance coverage (if any)

- Specific goals you want the life insurance to address (e.g., mortgage payoff, college education for children)

Step 2: Research Different Life Insurance Options

Familiarize yourself with the basic types of life insurance (term, whole life, universal life) and their pros and cons. This knowledge will help you ask informed questions and understand the advisor's recommendations better.

Here are additional steps to consider:

- Prepare Questions: Write down any questions or concerns you have about life insurance, coverage options, and affordability.

- Set a Budget: Determine a realistic budget for your monthly or annual premiums to guide your discussion with the advisor.

- Be Honest and Upfront: Provide complete and accurate information about your health and lifestyle habits, as these factors can affect your premiums.

- Don't Feel Pressured: Take your time, compare options, and feel comfortable saying no if a policy doesn't align with your needs and budget.

By following these steps and actively participating in your consultation, you can gain valuable insights, choose the right life insurance coverage, and ensure your loved ones are financially protected.

#LifeInsurance #LifeInsuranceConsultation #FinancialPlanning #FinancialSecurity #PeaceOfMind

Top 5 Reasons You Need a Personalized Insurance Review

Life is dynamic, and so are your insurance needs. It's easy to let your policies sit untouched for years, assuming they still offer the right protection. However, neglecting regular reviews can leave you exposed to financial risks. Here are the top 5 reasons why scheduling a personalized insurance review is crucial:

1. Changing Life Circumstances

Life throws curveballs, from career changes and new family members to unexpected expenses and health concerns. These milestones can significantly impact your insurance needs. A review ensures your coverage aligns with your current situation and protects you adequately.

2. Evolving Insurance Products and Market Trends

The insurance landscape constantly evolves, with new products, features, and coverage options emerging. A review allows you to explore these advancements and see if they align better with your current needs and budget.

Here are three other compelling reasons for a personalized insurance review:

- Identify Gaps in Coverage: Regular reviews help uncover any gaps or inadequacies in your existing policies, ensuring you have comprehensive protection.

- Optimize Costs and Premiums: The insurance market is competitive. Reviews allow you to compare quotes, negotiate better rates, and potentially save money.

- Peace of Mind and Security: Knowing your insurance coverage is tailored to your specific needs and up-to-date provides invaluable peace of mind and financial security.

Don't wait until it's too late. Schedule a personalized insurance review today and ensure your coverage reflects your ever-changing life and protects what matters most.

#InsuranceReview #FinancialPlanning #RiskManagement #PeaceOfMind #PersonalizedCoverage

Common Insurance Mistakes to Avoid: Tips from the Experts

Navigating the complex world of insurance can be tricky. Even the most informed individuals can make mistakes that could leave them financially exposed. To help you avoid these pitfalls, we've compiled expert insights on common insurance mistakes and how to steer clear of them:

Mistake #1: Underinsuring Yourself

To save money, some individuals opt for minimal coverage, only to realize later it's insufficient. Experts advise thoroughly assessing your needs and considering factors like potential future life changes or rising costs.

Mistake #2: Overinsuring Yourself

While underinsurance is risky, overpaying for excessive coverage is also wasteful. Experts recommend regularly reviewing your policies and adjusting them as your needs and budget evolve.

Here are some additional expert tips to remember:

- Shop around and compare quotes: Don't settle for the first offer. Get quotes from different insurers to find the best combination of coverage and price.

- Read the fine print: Understand exclusions and limitations in your policies to avoid unexpected gaps in coverage.

- Keep your policies updated: Inform your insurer about life changes like marriage, childbirth, or new property acquisitions to ensure accurate coverage.

- Seek professional advice: Consulting a financial advisor or insurance agent can help you tailor your coverage to your specific needs.

By avoiding these common mistakes and following expert advice, you can ensure you have the right insurance coverage in place to protect yourself and your loved ones financially.

#InsuranceMistakes #FinancialPlanning #RiskManagement #ExpertTips #PeaceOfMind

The Ultimate Guide to Life Insurance: What You Need to Know

Life insurance is a crucial component of financial planning, offering peace of mind and safeguarding your loved ones' financial future in the event of your passing. Whether you're just starting out or revisiting your coverage, understanding the fundamentals is key. Let's delve into the ultimate guide to life insurance:

Understanding the Basics

Life insurance provides a death benefit to your designated beneficiaries if you pass away while the policy is active. This financial cushion helps them cope with living expenses, debts, and other financial obligations you might leave behind. There are two main types:

- Term life insurance: Offers coverage for a specific period (term) at affordable rates. Ideal for temporary needs like raising children or paying off a mortgage.

- Permanent life insurance: Provides lifelong coverage and accumulates cash value over time. Offers additional benefits like policy loans and withdrawals.

Determining Your Needs

Choosing the right life insurance involves several factors:

- Income and expenses: Consider your dependents' living expenses, debts, and future needs.

- Financial goals: Assess if you need coverage for specific goals like college education or mortgage payoff.

- Age and health: Younger and healthier individuals typically qualify for lower premiums.

- Lifestyle and risk factors: Consider your occupation, hobbies, and family health history.

Remember, life insurance is a personal decision. Consulting a financial advisor can help you assess your needs and choose the right coverage.

#LifeInsurance #FinancialPlanning #PeaceOfMind #FinancialSecurity #FamilyProtection

Why Working with an Independent Insurance Agent Matters

Navigating the insurance landscape can be overwhelming, with countless companies and policies vying for your attention. In this scenario, independent insurance agents emerge as valuable allies, offering personalized guidance and access to diverse options. Let's explore why working with an independent insurance agent can be advantageous for you:

Wider Choice and Flexibility

Unlike captive agents representing only one company, independent agents work with multiple insurers. This grants you access to a broader range of policies and competitive rates, ensuring you find the coverage that best suits your needs and budget.

Personalized Expertise and Advocacy

Independent agents take the time to understand your individual circumstances, risk factors, and budget. They can then explain complex policies in easy-to-understand terms and recommend customized coverage options that align with your specific needs. Moreover, they act as your advocate, representing your interests when dealing with insurance companies.

Beyond these key benefits, independent insurance agents often offer:

- Convenient one-stop shopping for various insurance needs, saving you time and effort.

- Long-term relationships built on trust and understanding, ensuring consistent support throughout your journey.

- Accessibility and local knowledge, providing personalized service tailored to your community's needs.

Choosing the right insurance can significantly impact your financial security. By partnering with an independent insurance agent, you gain access to expert guidance, wider options, and personalized advocacy, empowering you to make informed decisions and secure the coverage that truly matters.

#IndependentInsuranceAgent #InsuranceOptions #PersonalizedCoverage #FinancialSecurity #PeaceOfMind

The Ultimate Guide to Term Insurance: What You Need to Know

Term insurance is a fundamental component of financial planning that provides essential coverage and financial protection. If you're navigating the world of term insurance, here's the ultimate guide to help you understand what you need to know:

Understanding Term Insurance

- What is Term Insurance: Term insurance is a type of life insurance that provides coverage for a specified term. It offers a death benefit to the beneficiaries if the policyholder passes away during the term.

- How Term Insurance Works: Term insurance works by paying a premium in exchange for coverage. It is straightforward, offering pure life insurance without any cash value component.

- Benefits of Term Insurance: Term insurance provides high coverage at an affordable premium. It is suitable for individuals looking for financial protection during specific life stages, such as raising a family or paying off a mortgage.

Planning with Term Insurance

- Determining Coverage Needs: Assess your financial obligations, including outstanding debts, future expenses, and income replacement needs. This helps determine the appropriate coverage amount.

- Choosing the Right Term: Select a term that aligns with your financial goals and the time period during which your dependents would need financial support.

- Reviewing and Updating: Periodically review your term insurance coverage to ensure it remains adequate as your financial situation evolves.

Term insurance is a valuable tool in securing your family's financial future. By understanding its nuances and incorporating it into your financial plan, you can achieve peace of mind knowing your loved ones are protected.

#TermInsurance #LifeInsurance #FinancialPlanning #InsuranceGuide #Coverage

Why Working with an Independent Insurance Agent Matters: Unveiling the Advantages

Navigating the complex world of insurance can be a daunting task, with numerous policies, coverage options, and carriers to choose from. In this sea of choices, the decision to work with an independent insurance agent can be a game-changer. In this blog post, we'll delve into the reasons why partnering with an independent insurance agent matters and how it can make a significant difference in securing the right coverage for your needs.

Unbiased Advice and Multiple Options:

Independent insurance agents are not tied to a single insurance company. This independence allows them to offer unbiased advice tailored to your specific requirements. Rather than being limited to the products of a single carrier, they have the flexibility to shop around and present you with multiple options, ensuring you get the coverage that best suits your needs and budget.

Personalized Service and Attention:

Working with an independent insurance agent means receiving personalized service and dedicated attention. These professionals take the time to understand your unique situation, whether you're an individual seeking life insurance or a business owner in need of comprehensive coverage. The result is a customized insurance solution designed to address your specific risks and priorities.

Local Expertise and Community Connection:

Independent agents are often deeply rooted in their local communities. This local expertise is invaluable when it comes to understanding the unique risks and challenges associated with specific regions. Moreover, their community connection allows them to offer insights into the insurance landscape that larger, non-local agencies may overlook.

Claims Advocacy and Support:

In the unfortunate event of a claim, an independent insurance agent acts as your advocate. They work on your behalf to ensure a smooth and fair claims process. Their commitment to your satisfaction extends beyond the initial policy sale, reinforcing the ongoing relationship and trust you've built together.

Simplified Comparison Shopping:

Rather than spending hours comparing policies from various insurance companies, independent agents streamline the process for you. They do the legwork, presenting you with clear and concise options, making it easier to understand the differences between policies and make an informed decision.

Financial Guidance and Risk Management:

Beyond insurance policies, independent agents often provide valuable financial guidance and risk management advice. They can assist in assessing your overall risk exposure, helping you make strategic decisions to protect your assets and achieve your long-term financial goals.

In a world where choices abound, the decision to work with an independent insurance agent is an investment in personalized service, expert guidance, and peace of mind. At [Your Agency Name], we take pride in our independence and commitment to our clients. Contact us today for a consultation, and let us be your trusted partner in protection.

#IndependentInsurance #InsuranceAdvisors #PersonalizedCoverage #LocalExperts #InsuranceChoices #ClaimsAdvocacy #RiskManagement #TrustedAdvisors #InsuranceSolutions #CommunityConnection #FinancialGuidance #CustomerExperience #InsuranceIndependence #CoverageOptions #ClientAdvocacy #InsureWithConfidence #InsuranceInsights #YourProtectionPartner #InsuranceConsultation #ExpertInsuranceAdvice

How to save for retirement

How to save for retirement: A comprehensive guide

Retirement is a time in life when you can finally relax and enjoy the fruits of your labor. But in order to retire comfortably, you need to save money while you're still working.

Saving for retirement can seem daunting, but it's actually quite simple. Here are a few tips:

Tips to save for retirement

- Start early: The earlier you start saving for retirement, the more time your money has to grow. Even if you can only save a small amount each month, it will add up over time.

- Set a goal: How much money do you want to have saved for retirement? Once you know your goal, you can create a plan to reach it.

- Choose the right retirement savings account: There are a variety of retirement savings accounts available, such as 401(k)s and IRAs. Choose an account that is right for you and your financial situation.

- Make regular contributions: Set up a recurring transfer from your checking account to your retirement savings account each month. This way, you'll save money without even having to think about it.

- Increase your contributions over time: As your income increases, try to increase your retirement savings contributions as well. This will help you reach your goal faster.

Here are some additional tips that can help you save more for retirement:

Additional Tips

- Live below your means: One of the best ways to save money is to spend less than you earn. Create a budget and track your spending so that you can see where your money is going.

- Cut back on unnecessary expenses: Do you really need that daily coffee run or that new subscription service? Take a close look at your expenses and see where you can cut back.

- Pay off debt: High-interest debt can drain your savings. Make a plan to pay off your debt as quickly as possible.

- Invest your money: Investing your money can help it grow faster. There are a variety of investment options available, so choose one that is right for your risk tolerance and time horizon.

Retirement planning can be complex, but it's important to start early and make a plan. By following these tips, you can save for a comfortable retirement.

#retirementPlanning #retirementSavings #retirementAccounts #retirementGoals #saveForRetirement #retirementTips #liveBelowYourMeans #cutBackOnExpenses #payOffDebt

How to get a personal loan with bad credit

If you have bad credit, you may think that it is impossible to get a personal loan. However, there are a few things you can do to increase your chances of approval and get a good interest rate.

Here are some tips on how to get a personal loan with bad credit:

Tips to get a personal loan with bad credit

- Choose the right lender: Not all lenders are created equal. Some lenders are more willing to work with borrowers with bad credit than others. Do some research to find lenders that specialize in personal loans for bad credit.

- Get pre-approved: Getting pre-approved for a loan before you apply can give you a good idea of your chances of approval and what interest rate you can expect. It can also help you shop around for the best deal.

- Apply with a co-signer: If you have a co-signer with good credit, it can increase your chances of approval and help you get a lower interest rate.

- Offer collateral: If you have collateral, such as a car or savings account, you may be able to get a secured loan. Secured loans are typically easier to qualify for than unsecured loans.

- Be honest and upfront about your financial situation: When you apply for a loan, be honest and upfront about your financial situation. This includes disclosing your bad credit history. Lenders are more likely to approve your loan if they know that you are honest and willing to work with them.

Here are some additional tips that can help you get a personal loan with bad credit:

Additional Tips

- Improve your credit score: Even if you have bad credit, there are steps you can take to improve your credit score over time. This includes paying your bills on time and keeping your credit utilization low.

- Get a credit-builder loan: A credit-builder loan is a small loan that is designed to help you improve your credit score. You typically borrow a small amount of money and make payments on time over a period of months or years.

- Consider a peer-to-peer loan: Peer-to-peer loans are loans that are funded by individual investors. Peer-to-peer lenders are often more willing to work with borrowers with bad credit than traditional lenders.

If you are struggling to get a personal loan with bad credit, don't give up. There are a few things you can do to increase your chances of approval and get a good interest rate.

#personalLoan #badCredit #creditScore #co-signer #collateral #honest #upfront #financialSituation #improveCreditScore #credit-builderLoan #peer-to-peerLoan

How to pay off debt faster

Debt can be a burden, both financially and emotionally. It can be difficult to make ends meet when you're paying off multiple debts, and it can be discouraging to see your progress slow. But there are things you can do to pay off debt faster and get your financial life back on track.

Here are some tips on how to pay off debt faster:

Tips to pay off debt faster

- Create a budget and track your spending: The first step to paying off debt is to understand your financial situation. Create a budget to track your income and expenses. This will help you to identify areas where you can cut back on spending.

- Prioritize your debts: Not all debts are created equal. Some debts, such as high-interest credit card debt, should be prioritized over others. Pay the minimum payment on all of your debts, but focus on making extra payments on your highest-interest debt.

- Use the snowball method or the avalanche method: There are two main debt repayment methods: the snowball method and the avalanche method.

- Snowball method: With the snowball method, you focus on paying off your smallest debts first. This can help you to build momentum and stay motivated.

- Avalanche method: With the avalanche method, you focus on paying off your highest-interest debts first. This can save you money on interest in the long run.

- Make extra payments: The more money you can put towards your debt each month, the faster you'll pay it off. Even if you can only make an extra $50 or $100 per month, it will make a difference over time.

- Consider a part-time job or side hustle: If you're struggling to make ends meet, consider getting a part-time job or starting a side hustle. This can give you extra money to put towards your debt.

- Negotiate with your creditors: If you're having trouble making your debt payments, consider contacting your creditors to see if they're willing to negotiate. They may be willing to lower your interest rate or monthly payment.

- Get debt counseling: If you're feeling overwhelmed by your debt, consider getting debt counseling. A debt counselor can help you to create a budget, negotiate with your creditors, and develop a plan to pay off your debt.

If you are struggling to get a personal loan with bad credit, don't give up. There are a few things you can do to increase your chances of approval and get a good interest rate.

#debtpayoff #personalfinance #financialliteracy #moneytips #budgeting #financialfreedom #creditcards #studentloans #mortgages #sidehustle #financialadvice #debtcounseling

Best Indian Stocks to Watch in 2023: A Comprehensive Guide

Investing in the Indian stock market offers exciting opportunities for growth and wealth creation. As we step into 2023, the financial landscape presents a myriad of possibilities for savvy investors. To help you navigate this dynamic market, we've compiled a list of the best Indian stocks to watch in 2023.

Here are some best Indian Stocks in 2023:

Reliance Industries Limited (RIL)

- Sector: Conglomerate

- Why Watch: RIL has been a market leader, and its diversified business portfolio, including telecommunications, retail, and petrochemicals, positions it for continued success in 2023.

Infosys Limited

- Sector: Information Technology

- Why Watch: As a prominent IT services company, Infosys is well-positioned to benefit from the global demand for digital transformation. Keep an eye on its innovative solutions and global expansion.

HDFC Bank Limited

- Sector: Banking and Finance

- Why Watch: HDFC Bank is known for its strong financials and customer-centric approach. With the growth potential in India's banking sector, HDFC Bank remains a key player.

Bajaj Finance Limited

- Sector: Non-Banking Financial Company (NBFC)

- Why Watch: Bajaj Finance has been a consistent performer in the NBFC space. Its focus on consumer finance and diversified product offerings make it a noteworthy stock for 2023.

.png)

Tata Consultancy Services (TCS)

- Sector: Information Technology

- Why Watch: TCS is a global IT services giant with a strong reputation. As businesses worldwide continue to invest in technology, TCS is poised for sustained growth.

ICICI Bank Limited

- Sector: Banking and Finance

- Why Watch: ICICI Bank's innovative financial products and services contribute to its robust market presence. Keep an eye on its strategic initiatives and digital banking advancements.

Adani Green Energy Limited

- Sector: Renewable Energy

- Why Watch: With a focus on sustainable energy solutions, Adani Green Energy is a key player in India's renewable energy sector. As the world shifts towards clean energy, this stock holds promise.

Asian Paints Limited

- Sector: Paints and Coatings

- Why Watch: Asian Paints is a leader in the decorative paints segment. As the real estate market thrives, demand for its products is likely to remain strong.

ITC Limited

- Sector: Conglomerate (FMCG, Hotels, Paperboards)

- Why Watch: ITC's diversified business model and commitment to sustainability make it an interesting stock to watch in 2023. Keep an eye on its FMCG and hospitality segments.

UltraTech Cement Limited

- Sector: Cement

- Why Watch: With a robust presence in the cement industry, UltraTech Cement is well-positioned to benefit from infrastructure development projects across the country.

Disclaimer: This list is for informational purposes only and does not constitute financial advice. Always conduct thorough research or consult with a financial advisor before making investment decisions.

As you navigate the exciting world of Indian stocks in 2023, remember that a well-informed investor is a successful investor. Stay tuned to Makvik Financial Services for more market insights, investment strategies, and expert analysis.

Happy investing!

#StockMarket #Investing #IndianStocks #FinancialFreedom #StockPicks #MarketWatch #InvestmentTips #WealthCreation #EconomicOutlook #FinanceNews #MarketTrends #StockAnalysis #InvestmentOpportunity #EquityMarkets #MoneyMatters #StocksToWatch #MarketInsights #InvestmentPortfolio #EconomicForecast #StockTips2023

We specially deal with startups to provide most suitable & creative solution to assist in establishing, processing & managing the business with professional team.